ABOUT THE SERVICE A Community Tax Certificate (CTC) is a form of identification issued by the cities and municipalities to all individuals that have reached the age of 18 years old. CTC is a proof that an individual is a resident of the city/Municipality and that he/she paid the necessary dues arising from income derived from business, exercise of profession, and/or ownership of real properties in the area. It is paid during the beginning of the year at the Municipal Treasurer’s Office. After February 28, a penalty interest is imposed on the total tax due computed on a monthly basis.

CLIENT GROUP General Public (18 years old and above)

REQUIREMENTS – Information Sheet (Inclusive of complete name, complete address, date and place of birth, civil status)

-For employed, proof of income (Form W2)

– For business, appropriate proof of income and/or assessment

FEES/PAYMENT REQUIRED COMMUNITY TAX CERTIFICATE- INDIVIDUAL

BASIC COMMUNITY TAX – P 5.00

ADDITIONAL COMMUNITY TAX – not to exceed P 5,000.00

-Gross Receipt or Earnings from Business during the preceding year

P 1.00 for every P 1,000.00

-Salaries or Gross Receipt or Earnings derived from exercise of

Profession – P 1.00 for every P 1,000.00

-Income from Real Property – P 1.00 for every P 1,000.00

COMMUNITY TAX CERTIFICATE – CORPORATION

BASIC COMMUNITY TAX – P 500.00

ADDITIONAL COMMUNITY TAX – Not to exceed P 10,000.00

-Assessed Value of Real Property owned in the Philippines.

P2.00 for every P5, 000.00

-GROSS RECEIPTS including dividend earnings derived from business in the Philippines during the preceding year P2.00 for every P5, 000.00

SERVICE SCHEDULE Monday to Friday (8:00 am – 5:00 pm)

TOTAL PROCESSING TIME Five (5) minutes

PROCESS OF AVAILING THE SERVICE

| STEPS INVOLVED | ACTION OF THE OFFICE OF THE MUNICIPAL TREASURER | TRANSACTION TIME | PERSON/S RESPONSIBLE |

| Fill out the application sheet at the counter and present accomplished form. Present proof of income for employed individuals or as per assessments for business establishments | Validates the form and computes payment for the CTC | 2 minutes | Revenue Collection Clerk/Staff |

| Pay the required amount as per computed/assessed value | Prepare the CTC | 2 minutes | Revenue Collection Clerk/Staff |

| Have the individual affix his/her signature and thumb mark at the CTC prior to release | Make sure that the triplicate CTC were signed and thumb marked and have it released | 1 minute | Revenue Collection Clerk/Staff |

Republic of the Philippines

Province of Rizal

Municipality of Angono

OFFICE OF THE MUNICIPAL TREASURER

ASSESSMENT AND COLLECTION OF REAL PROPERTY TAXES

ABOUT THE SERVICE Real properties such as land, buildings and machineries are assessed by the Municipal Assessor’s Office and real property taxes are due every year based on the assessment level and fair market value of the real property. The Real Property payment is made at the Land Tax Section of the Municipal treasurer’s Office.

Payments can be made in annual, semi-annual, or quarterly basis.

CLIENT GROUP Individuals and/or corporation who own real property in the Municipality

REQUIREMENTS – Official receipt of previous year or latest real property tax payments

-Real Property Tax Order of Payment (RPTOP)/Statement of Account

FEES/PAYMENT REQUIRED 1% Basic and 1% SEF of the assessed value plus penalties, if applicable

SERVICE SCHEDULE Monday to Friday (8:00 am – 5:00 pm)

PROCESS OF AVAILING THE SERVICE

| STEPS INVOLVED | ACTION OF THE OFFICE OF THE MUNICIPAL TREASURER | TRANSACTION TIME | PERSON/S RESPONSIBLE |

| Individuals may present latest RPT payment or Statement of Account for the computation of Real Property Tax Due | Statement of Account based on records | 3-5 minutes | Revenue Collection Clerk/Staff |

| Payment of Real Property Tax | Prepare Official Receipt of RPT and Accepts payment | 3 minutes/OR | Revenue Collection Clerk/Staff |

REMINDER:

– ADVANCE PAYMENT – If Real Property Taxes are paid in full before January 1, advance payment may be given a discount of 20%.

– PROMPT PAYMENT – if Real Property Taxes are paid on or before the deadline as provided in Article 342 of Rules and Regulations implementing the Local Government Code.

– PENALTY – as per schedule of interest for the years not paid.

Republic of the Philippines

Province of Rizal

Municipality of Angono

OFFICE OF THE MUNICIPAL TREASURER

ACCEPTANCE OF MISCELLANEOUS FEES

ABOUT THE SERVICE The Municipal Treasurer’s Office is the only centralized office to receive all kinds of payments and issue official receipts for all the services provided by the Municipality

CLIENT GROUP General Public

REQUIREMENTS Order of payment from the referring office

FEES/PAYMENT REQUIRED Police Clearance Php 100.00

Certified True Copy of

Birth Certificate/Marriage Contract/ Php 100.00

Death Certificate

Tax Clearance Php 100.00

Secretary’s Fee Php 100.00

Miscellaneous Certification Php 100.00

Mayor’s Clearance Php 100.00

*Plus Documentary Stamp Tax Php 15.00

Miscellaneous fees that has variable rates

Business Tax/Mayor’s Permit

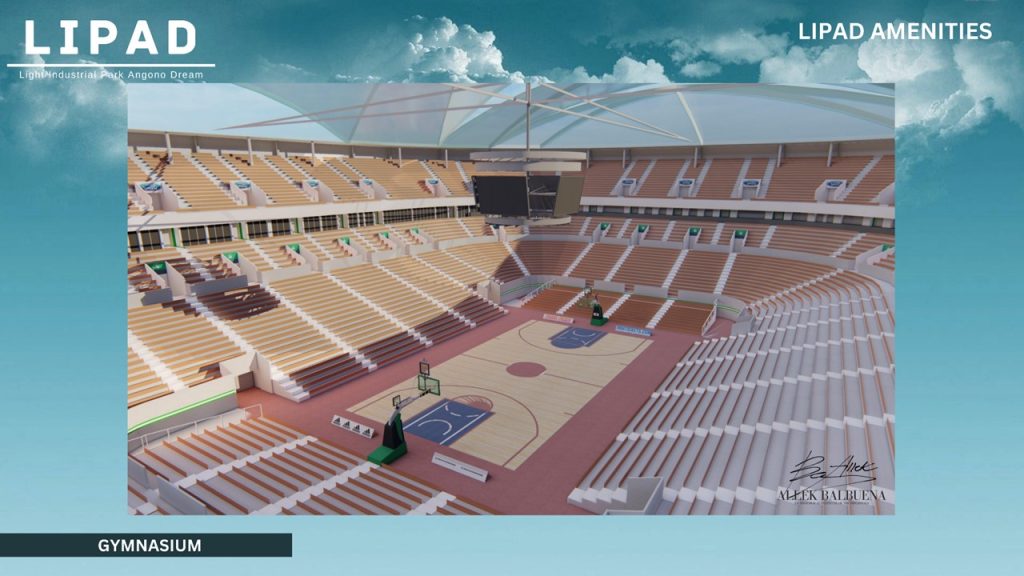

Use of the Municipal Gymnasium

Posting of streamers and installation of billboards

Building and electrical permit

Imposed penalty on violations of traffic rules and regulations

Franchise Fee

Cemetery Fee

Others

SERVICE SCHEDULE Monday to Friday (8:00 am – 5:00 pm)

TOTAL PROCESSING TIME 3 minutes

PROCESS OF AVAILING THE SERVICE

| STEPS INVOLVED | ACTION OF THE OFFICE OF THE MUNICIPAL TREASURER | TRANSACTION TIME | PERSON/S RESPONSIBLE |

| Present the order of payment coming from the referring department | Accepts payment and prepares/ issues the official receipt | 3 minutes | Revenue Collection Clerk/Staff |

| Proceed to the referring department for the subsequent procedures of the services being availed of |

Republic of the Philippines

Province of Rizal

Municipality of Angono

OFFICE OF THE MUNICIPAL TREASURER

PAYMENT OF SALARIES, WAGES, FINANCIAL ASSISTANCE

Client Group- Municipal Employees, General Public

REQUIREMENTS

-Payment of salaries and wages

Approved Daily Time Record

1. Valid IDs

2. For representative – Authorization Letters

-Payment of Financial Assistance

1. Letter from DSWD for identification

2.Valid ID’s

3.For representative –Authorization Letter

SERVICE SCHEDULE Monday to Friday (8:00 am – 5:00 pm)

PROCESS OF AVAILING THE SERVICE

| STEPS INVOLVED | ACTION OF THE OFFICE OF THE M MUNICIPAL TREASURER | TRANSACTION TIME | PERSON/S RESPONSIBLE |

| Present the Requirement | Pay the – salaries -wages – financial assistance | 3 minutes | Disbursing Officer |